Add your voice by March 31, 2026, as we gather resident feedback on budget priorities, City services, and quality of life in Leduc.

Budget Planning & Citizen Satisfaction Survey

Budget Basics

Leduc’s budget is our plan for how money will be collected and spent to support the programs, services, and infrastructure our community needs.

Each year, we review and approve the budget with a focus on both short-term and long-term goals. The operating budget looks three years ahead, while the capital budget looks ahead ten years. This helps the City provide steady services and prepare for future growth by planning and saving for big projects.

Since community needs and financial situations can change, we review and adjust the budget every year based on new needs, unexpected economic shifts, or changes in funding from the province or federal government.

Operating Budget

- Covers the cost of services and programs for Leduc’s residents and businesses, like social services, water and sewer, snow removal, fire and emergency services, waste collection, and recreation facilities.

- The City can’t plan for a deficit under Alberta’s Municipal Government Act. This means we must bring in enough money to cover all our expenses each year.

- The operating budget is paid for by property taxes, provincial and federal grants, user fees and drawing from the City’s operating reserves.

Capital Budget

- Covers the cost of building, maintaining and improving city buildings, parks, roads, and recreation spaces. Some projects are big and take a few years to finish, so the costs are spread out over time.

- The City’s capital projects are paid for through developer contributions, provincial and federal grants, tax-supported debt and drawing from the City’s capital reserves.

2026 Budget

City Council deliberated the 2026 Proposed Budget over a series of public meetings in November and December. On Dec. 8, Council approved the 2026 Operating Budget and 2026 Capital Budget, maintaining services levels while limiting tax impacts for residents.

Through budget preparation and deliberations, Council and Administration reduced the initial forecasted tax increase from 6.3% to 3.8% by identifying cost-saving opportunities and efficiencies in discretionary spending. Continued community growth also helped limit the tax revenue requirement while ensuring essential programs and services continue sustainably.

Tax impacts for property owners will not be known until the spring, once property assessments are complete and Council sets property tax rates.

Operating Budget

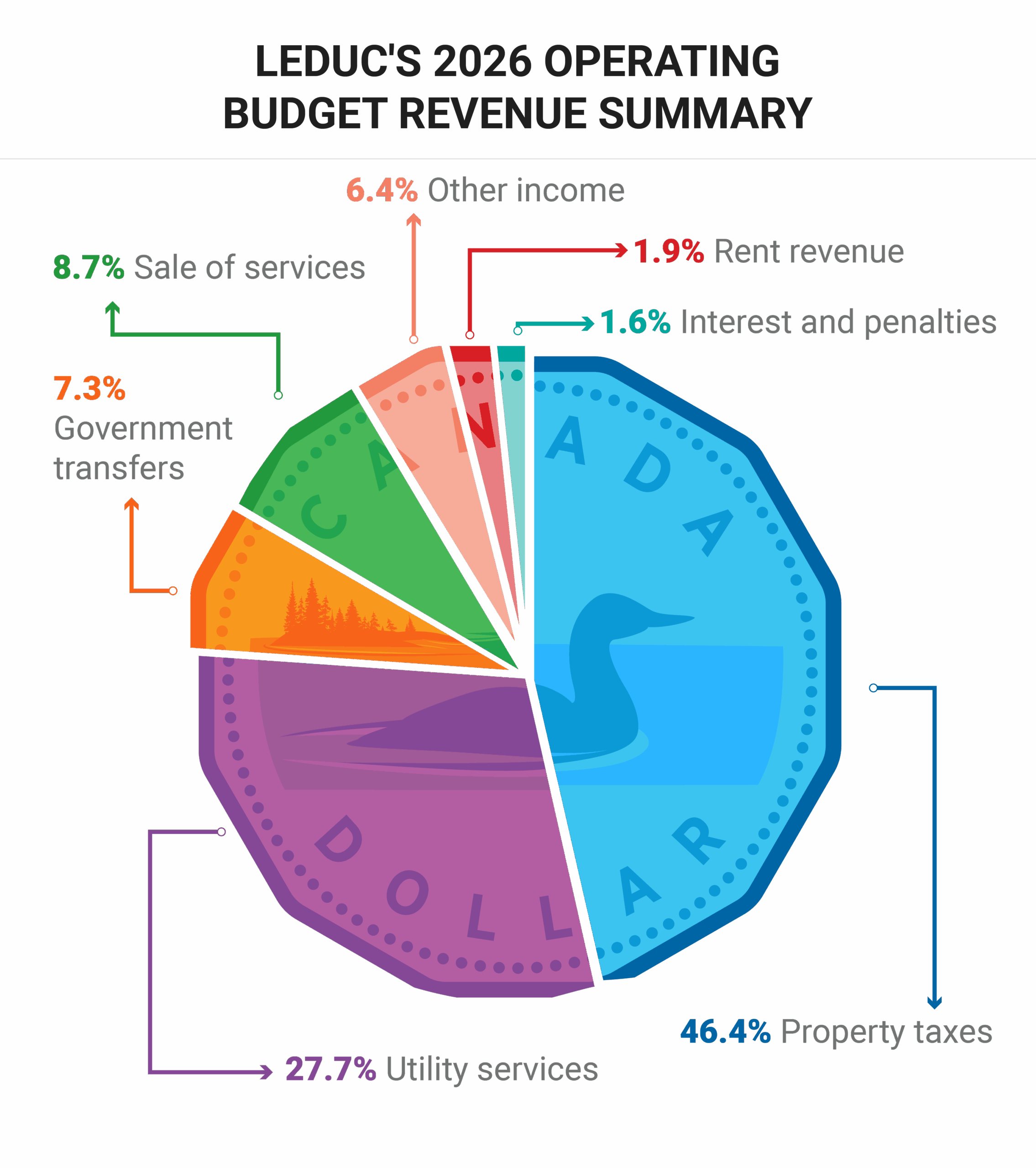

The 2026 Operating Budget requires a projected revenue of $149.1 million to cover programs and services such as snow removal, fire and ambulance, policing and security, transit, recreational facilities, and community events. While property taxes contribute to this revenue, the City also collects revenue from utilities, government grants, service fees, rent, interest and penalties.

Capital Budget

The City of Leduc has a sustainable 10-year capital plan that focuses on maintaining the City’s $1.5 billion of existing critical infrastructure, while investing in new infrastructure to support community growth. Capital expenses in 2026 are budgeted at $40.1 million and include projects such as:

- New, accessible Lions Park outlook on Telford Lake

- Reconfiguring the K9 Off-Leash Dog Park (to accommodate a proposed new school)

- Permanent off-leash dog park in Deer Valley, accelerated to 2026 based on high interest from the pilot project

- Fire Hall 3

- Road work: overlays on Sparrow Drive, 50 Street and 50 Avenue and 74 Street roundabout construction

These projects will be funded through City reserves, grants, off-site levies (developer contributions) and tax supported debenture borrowing.

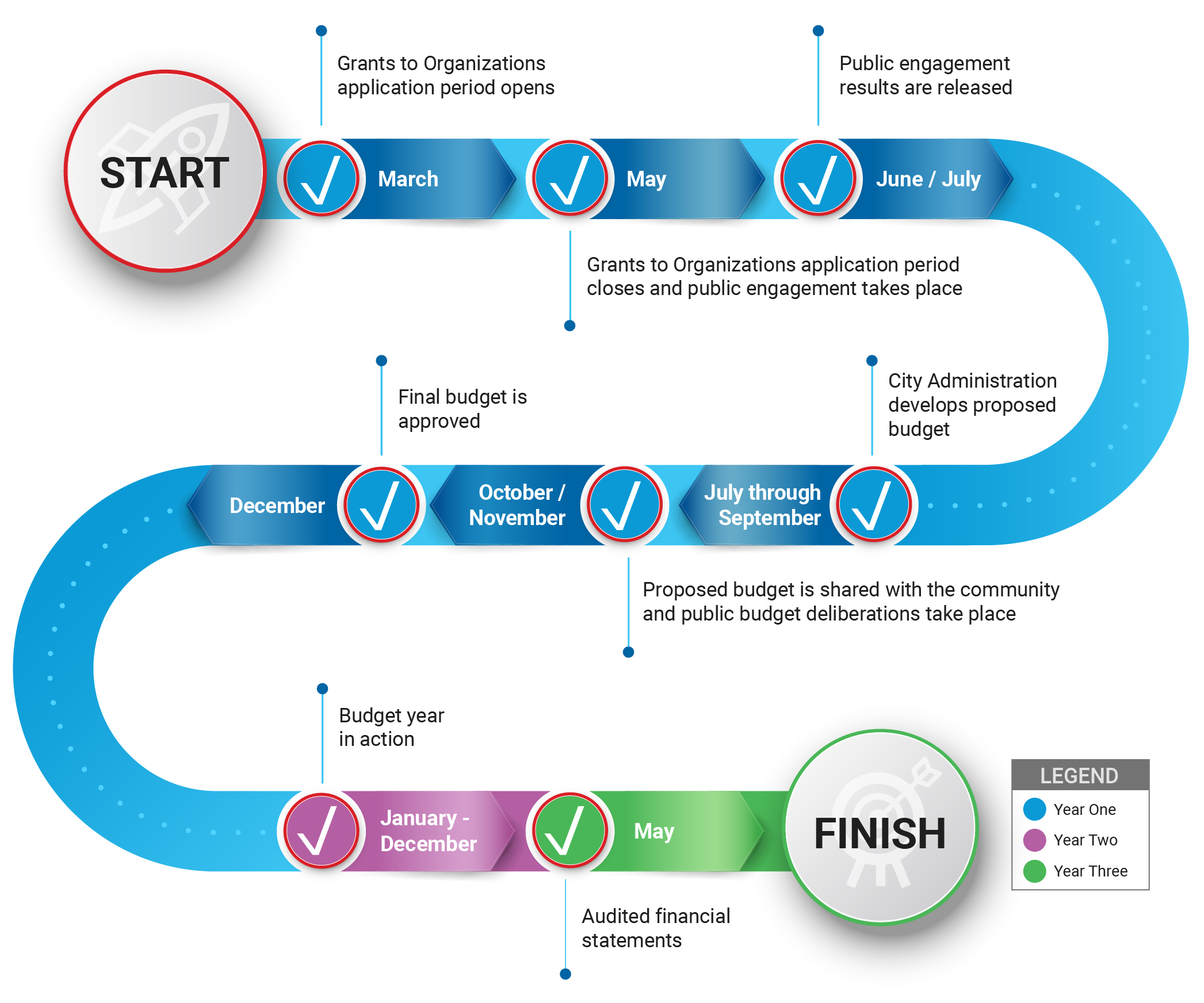

Budget Planning Process and Timeline

Each budget year spans three years.

Budgets

Current Budget

Previous Budget

Utility Fees

Utility fees collected by the City fund essential services like water, sewer, garbage collection and stormwater infrastructure. While the City sets some of these rates, others are established by external service providers and flow through the City to customers.

For 2026, Arrow Utilities, the Capital Region Southwest Water Services Commission (CRSWSC) and the City have all adjusted water and wastewater rates, with Arrow and CRSWSC accounting for about 64% of the total increase. These adjustments ensure infrastructure and systems remain reliable, properly maintained, and able to support the community’s long-term needs.

Explore conservation tips to help manage your household water use.

Utility Fees

| Utility | 2026 Fees and Charges | Increase from 2025 |

|---|---|---|

| Water | $ 11.21 per month plus $3.10 per cubic meter | 22 cents per month; 20 cents per cubic meter |

| Wastewater | $10.40 per month plus $3.71 per cubic meter | 20 cents per month; 86 cents per cubic metre |

| Stormwater | $7.50 per month | $1 .00 per month |

| Solid Waste | $26.60 per month | 77 cents per month |

Franchise Fees

The City of Leduc charges franchise fees to utility operators who have exclusive rights to provide utility services within the city. These fees are included on consumer bills and remitted to the City.

To help build reserves that support long-term financial sustainability and future community amenities, City Council approved updates to franchise fees in the 2026 budget: an increase of 2% for electricity and 4% for gas. Franchise fees are an alternative way for the City to raise revenue, reducing pressure on property taxes while supporting essential services.

These adjustments ensure that all users—including those exempt from property taxes, such as healthcare facilities, non-profit organizations, schools and places of worship—contribute fairly to the cost of essential services we all depend on.

Budget FAQ

Generally, the top three service areas in the 2026 operating budget are utility services, public services, and fire and ambulance services.

Every year, City Administration prepares a three-year operating budget and 10-year capital plan and presents it to the City Council for feedback and approval. When the 2026 operating budget was approved in early December, Council approved estimated revenues and spending for the next immediate fiscal year, and, in principle, the following two years. A three-year capital budget was approved in 2024. In early December, Council approved changes to 2026 and, in principle, the following nine years.

Capital projects are paid for through developer contributions, provincial and federal grants, tax-supported and off-site supported debt and drawing from the City’s capital reserves.

The City has several measures to ensure that money is spent wisely:

- A formal budgeting process which includes collaboration between Council and Administration, and public engagement. This process includes a detailed analysis of past spending, current economic conditions, public feedback and the needs of the community to determine which services and projects should be continued/discontinued, introduced or increased/decreased. Funds can only be spent if they are approved by Council.

- The City issues and publicly reports annual financial statements featuring budgeted versus actual information. These financial statements show how property taxes and other revenues have been allocated. Additionally, the City publishes an annual report to report on spending, performance measures and detailed information on initiatives accomplished throughout the past year.

- The City’s financials are audited each year by an independent auditor who provides an opinion on whether the financial statements fairly represent the City’s financial position. The results of the audit help ensure funds are used appropriately and there are no discrepancies in the financial reporting.

- City Council maintains oversight of the budget by requiring Administration to report on the status of current budget spending on a quarterly basis, providing transparency and accountability.

Every year, an independent auditor reviews the city’s financial statements in accordance with the generally accepted Canadian auditing standards.

These are determined based on several factors including the cost of providing these services, external provider rates, benchmarking with other municipalities in the region and applicable legislation.

Debt servicing costs affect the operating budget when the projects are City funded. (Not funded through off-site levies or developer funding). These costs are included in the City’s operating budgets for the term of the debentures.

There are several reasons why two cities with the same population may have different operating budgets:

- Cities may offer different levels or scopes of services. For example, the City of Leduc owns and operates the Leduc Recreation Centre. The TransAlta Tri Leisure Centre is co-owned by three municipalities but operates as a corporation and is governed by a board of directors.

- Labour costs can vary depending on the cost of living in a city, union contracts, and collective bargaining agreements.

- Differences in geography affect costs. Cities spread over a larger area will have increased costs for things like road maintenance and transit.